How Hiring Your Child Can Cut Payroll Taxes: IRS-Approved Tax Strategy for Family Businesses

The IRS offers tax breaks for family-run businesses who employ their children, but you must follow the rules carefully.

Here How the Tax Benefits Work:

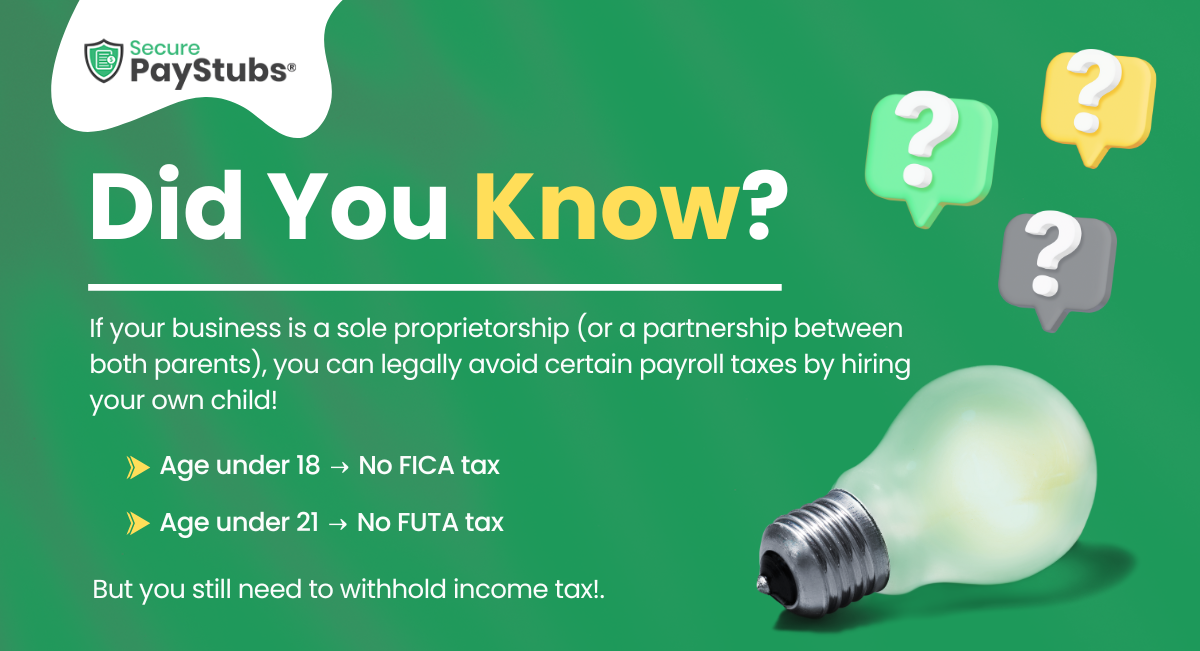

If your child is under 18:

You are exempt from paying FICA taxes (Social Security and Medicare) on their wages.

If your child is under 21:

You are also exempt from paying FUTA taxes (Federal Unemployment Tax).

These savings can be substantial, especially if your child helps regularly in your business whether it's data entry, packaging, social media, or other tasks suited to their age and skills.

But Don’t Forget:

You still need to withhold federal income tax from your child’s pay, unless they qualify for exemption based on income level and filing status.

Also:

- The work must be legitimate and appropriate for their age

- Wages must be reasonable for the work performed

- You must track hours and pay just like any other employee

Why Do This?

- You reduce your taxable income.

- Your child gains valuable work experience.

- You keep money in the family literally.

- Your child can fund their savings, education, or even a Roth IRA!

Just ensure the job is age-appropriate, your child actually performs work, and the pay is reasonable for the tasks done.

This tax-saving opportunity is straight from the IRS playbook it’s not a loophole; it’s a smart strategy

How SecurePayStubs Helps:

Professional Paystub Generation:

Easily create clear, compliant paystubs for your child just like you would for any employee. Show hours worked, wages earned, and withheld taxes with precision.

Tax Breakdown Made Simple:

SecurePayStubs automatically calculates FICA, FUTA, and income tax and helps you apply correct exemptions for underage employees under IRS rules.

Record-Keeping for Audits:

In case the IRS ever audits your business, accurate paystubs act as proof that the work and wages were legitimate. SecurePayStubs ensures you’re ready.

Easy for Small Businesses:

Whether you are a sole proprietor or a family-run partnership, you don’t need a full payroll system just a fast, affordable way to stay compliant. That’s exactly what SecurePayStubs offers.